Editorials

Neelie Kroes

The European software industry is thriving. Revenue and growth figures in the sector show the importance of its contribution to the European economy at a time of fierce global competition.

We should all the more commend the achievements of the software industry, and acknowledge that the impact of those achievements go much beyond the sector itself. When looking at the bigger picture, we realise that software, has become a key enabling technology underlying all economic sectors and activities. Software services and applications are a major contributor to competitiveness: it greatly improves operations and services, and it also allows for the creation of new businesses and activities that would not exist without it.

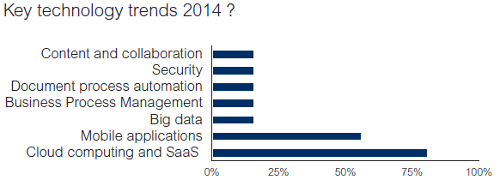

The conclusions of the European Council meeting on 24-25 October 2013 call Europe to boost digital, data-driven innovation in all sectors of the economy and specifically identify cloud computing as a strategic technology enabling increased productivity and better services.

The software industry is heavily investing in the development of infrastructure, platforms and applications as cloud services. Cloud computing is expected to bring significant changes, not only in the way the software industry itself operates, but also in the way the other sectors, including the public sector, take advantage of software technologies to enhance and optimise their activities.

The European Commission contributes to supporting those changes at the policy level through the Digital Agenda for Europe, in particular through the implementation of the European Cloud Strategy and enhanced investment at the research & innovation level in the Horizon 2020 Programme.

The European Cloud Strategy is articulated along three axes: application interoperability and data portability standards for reducing the risks of lock-in; safe and fair contract terms and conditions for easing the take-up of cloud services; and the European Cloud Partnership for defining common cloud procurement requirements for the public sector.

Software & Services and Cloud Computing research and innovation was already part of the Information and Communication Technologies theme of the 7th EU Framework Programme of the Commission.

The forthcoming Horizon 2020 Work Programme 2014-2015 expands those activities significantly, so that Europe can be at the forefront in the field and drive the changes. New instruments, like the Public Procurement for Innovative solutions and Pre-Commercial Procurements of innovative cloud computing solutions are intended to facilitate and foster the take-up of cloud computing services by the public sector.

You can count on me to bring continued Commission support to entrepreneurship and further developments in the software sector, especially at a time where major technological changes like the cloud are creating new challenges and opportunities.

European Commissioner for the Digital Agenda

Bernard-Louis Roques

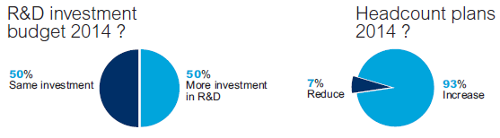

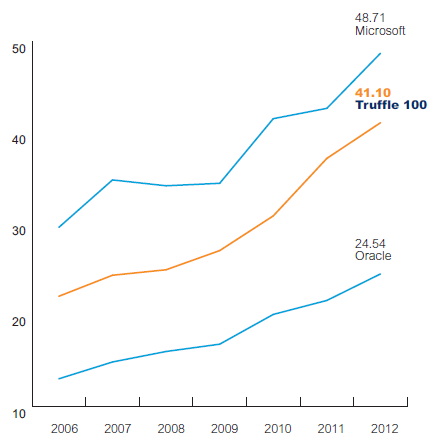

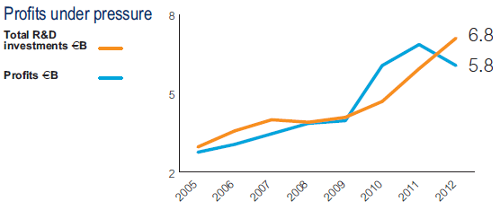

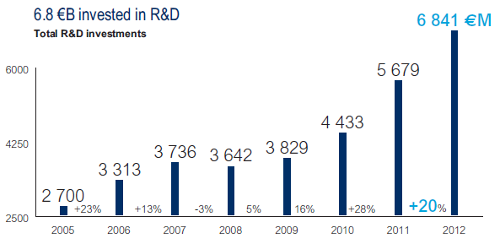

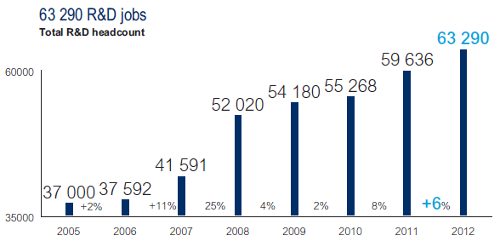

This latest edition of the Truffle 100 Europe, the 8th, shows that the European software sector remains a force to be reckoned with, regardless of the economic environment. Despite an 8.7% decline in profits, editors invested more than they earned, showing faith and optimism in the future. As a result, R&D investments went up 20% and the number of R&D jobs rose by 6%. With 63,000 qualified jobs, low outsourcing numbers and 6.8 million€ invested for development works on future products, the software industry remains an unwavering catalyst for innovation, a key driver of European economic growth, and plays a critical role in job creation policies for generations to come.

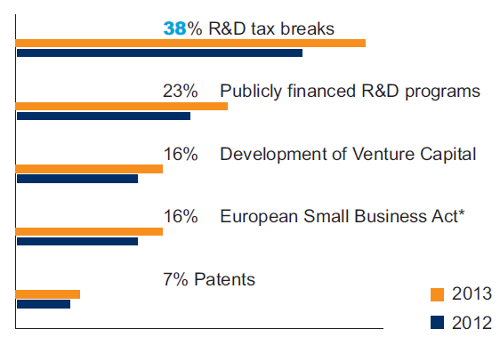

Due to rising global competitiveness, the software industry needs more support from public authorities especially through tax releif, tax incentives for venture capital and the famous yet ignored &laqou;European Small Business Act&raqou;*.

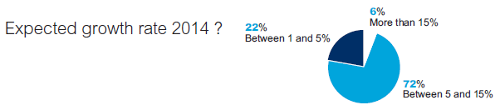

European software entrepreneurs foresee a 5 to 15% growth in 2014 versus 10% last year, an optimistic view despite changing business models that push editors to perpetually reinvent themselves in the age of cloud computing, Saas and Mobility.

General Partner & co-Founder, Truffle Capital

Bo Lykkegaard

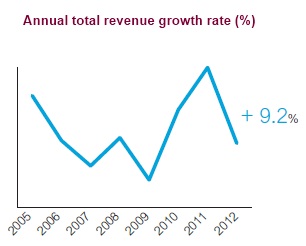

The European software industry is in growth mode despite the difficult economic climate in the region. The combined software revenue of the Truffle 100 companies grew 11% in 2012 over 2011. This is encouraging given that IDC measured growth rate of European domestic software demand of approximately 4% in 2012. This difference shows that European ISVs are tapping into spending growth outside Europe, particularly in the US, but also in emerging markets in Middle East and Africa, Latin America, and Asia Pacific. During first half of 2013, software demand in Europe has increased by 4%, driven in particular, by new technologies such as cloud computing, big data analytics, and social/collaborative applications. In reality, we are seeing a boost in demand for a new breed of enterprise software, which is inspired by Google, Apple, and Facebook. These new paradigms for the software user experience are not only changing the look and feel of enterprise software, but are enabling new business models and business processes inside and between organizations. Employees can engage with customers via social communities, companies can make complex decisions on what to offer in real-time, and employees can use business application that resemble consumer applications on a smart phone or tablet.

This technology shift represents a major opportunity for European ISVs. New or recent entrants in the Truffle 100, such as Emailvision and Thunderhead.com, are completely cloud-based and are seeing strong growth rates as European organizations are starting to embrace the idea of subscription-based business solutions delivered over the Internet. Many of the established European ISVs are also investing significant resources in developing and selling cloudbased solutions. IDC believes that the ability for European ISVs to transform their offerings and align them with what IDC calls the 'Third Platform' (a new technology platform for growth and innovat ion characterized by technologies such as cloud computing, smart mobile devices, social networks, and realtime analytics) will be the number one determinant of the future viability of Europe's software industry.

Research Director, European Enterprise Applications, IDC

Laurent Calot

We are currently experiencing a historical turning point: the global adoption of SaaS, a revolutionary software marketing model. SaaS is now riding the wave of Cloud and forms the third pillar alongside infrastructure service (IaaS) and the development service (PaaS): it constitutes the information system's application layer. The entire reasoning behind the construction of information systems is questioned with this new model.

As cost-efficiency is now inevitable, the concept of outsourcing has spread to all companies, including key accounts who no longer consider SaaS as a mere experiment but who are looking to apply it to their most commonly-used management applications which will hopefully become the future's most strategic applications.

Software Vendors are becoming more aware that the SaaS/cloud phenomenon is a real chance for economic growth, which has led to the model's upward trend. Thanks to Cloud, promising new markets are being conquered, especially on an international level. For vendors who may not have the means to cover all areas of management or to meet repurchasing requirements, the cloud model is in fact an extraordinary lever for creating and developing new business opportunities, supported by an entire network of partners - either specialists in new functional areas or well-established local stakeholders in specific geographical zones throughout the world. Our developers would not be able to ensure sufficient growth to reach international markets without the cloud system, but if they seize this opportunity, the world could become their oyster.

CEO, CXP Group

Figures

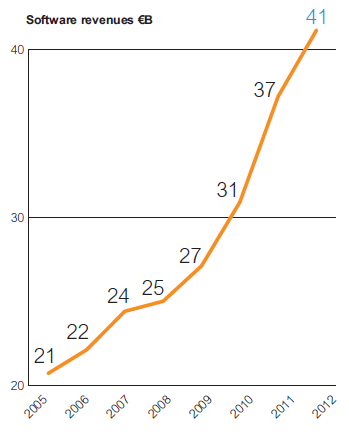

11% growth in software revenues at 41.1 €B

Total revenues for the Truffle 100 are 57.8 €BMore concentration, 76% of revenues come from Top 25 (77 % last year)

| % Revenues | 2010 | 2011 | 2012 |

|---|---|---|---|

|

SAP |

31 % | 38 % | 39 % |

| TOP 3 | 40 % | 46 % | 47 % |

| TOP 5 | 44 % | 53 % | 53 % |

| TOP 10 | 52 % | 63 % | 63 % |

| TOP 50 | 84 % | 90 % | 90 % |

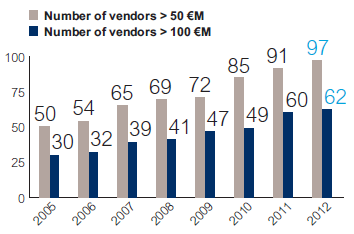

All Truffle 100 have revenues > 46 €M

97 vendors have revenues >50 €M

62 vendors have revenues >100 €M

They account for 94 % of Truffle 100 revenues

42 vendors have revenues >200 €M

They account for 87 % of Truffle 100 revenues

Lower profits

5.8 €B aggregated net profits, down from 6.6 B€B last year

| Profits €B | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|

| 2.8 | 3.2 | 3.6 | 3.7 | 5.8 | 6.6 | 5.8 |

| Profits | |||||||

|---|---|---|---|---|---|---|---|

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | % of revenues T 100 | |

| SAP | 60% | 51% | 46% | 31% | 52% | 48% | 39% |

| TOP 3 | 73% | 62% | 58% | 40% | 60% | 58% | 47% |

| TOP 5 | 75% | 67% | 66% | 44% | 66% | 65% | 53% |

| TOP 10 | 75% | 67% | 66% | 52% | 79% | 79% | 63% |

| TOP 50 | 95% | 92% | 91% | 84% | 96% | 95% | 90% |

Top 5 countries in Europe represent 86.4% of software revenues

| Country | 2010 | 2011 | SW revenues (€M) 2012 | % of total | # SW companies |

|---|---|---|---|---|---|

| Germany | 15 578.0 | 18 145.7 | 20 328.6 | 49.4% | 14 |

| UK | 5 752.0 | 5 497.3 | 5 994.6 | 14.6% | 22 |

| France | 3 482.0 | 4 040.9 | 4 348.9 | 10.6% | 19 |

| Sweden | 977.0 | 2 163.5 | 2 326.5 | 5.7% | 9 |

| Netherlands | 1 093.0 | 2 187.9 | 2 236.2 | 5.4% | 7 |

| Norway | 436.0 | 1 110.8 | 1 208.2 | 2.9% | 3 |

| Finland | 661.0 | 1 005.5 | 1 152.4 | 2.8% | 6 |

| Italy | 522.0 | 618.1 | 625.0 | 1.5% | 3 |

| Switzerland | 881.0 | 530.1 | 594.9 | 1.4% | 5 |

| Belgium | 511.0 | 516.5 | 557.3 | 1.4% | 1 |

| Poland | 562.0 | 486.2 | 544.8 | 1.3% | 2 |

| Denmark | 185.0 | 248.5 | 361.9 | 0.9% | 2 |

| Czech Republic | 166.0 | 194.4 | 287.0 | 0.7% | 2 |

| Spain | 117.0 | 149.1 | 256.4 | 0.6% | 2 |

| Slovakia | - | 176.7 | 198.4 | 0.5% | 1 |

| Austria | 62.0 | 116.4 | 126.3 | 0.3% | 2 |

| TOTAL | 30 985.0 | 37 187.7 | 41 147.7 | 100.0% | 100 |

World-class national champions

| Vendor | Country | Revenues (€M) | % of Truffle 100 |

|---|---|---|---|

| SAP | DE | 15 930 | 38.7% |

| Dassault Systemes | FR | 1 853 | 4.5% |

| Sage | UK | 1 591 | 3.9% |

| Hexagon | SE | 1 283 | 3.1% |

| Wincor Nixdorf | DE | 1 257 | 3.1% |

Exceptional commitment to innovation

Top 5 countries represent 84% of total R&D jobs

| Countries | Number of R&D employees | % of total | R&D investment (€M) | % of total |

|---|---|---|---|---|

| Germany | 23 783 | 37.6% | 2 837.7 | 41.5% |

| France | 9 962 | 15.7% | 960.6 | 14.0% |

| UK | 8 375 | 13.2% | 1 043.4 | 15.3% |

| Netherlands | 6 321 | 10.0% | 713.2 | 10.4% |

| Sweden | 4 503 | 7.1% | 438.2 | 6.4% |

| Poland | 3 569 | 5.6% | 75.2 | 1.1% |

| Italy | 1 634 | 2.6% | 99.4 | 1.5% |

| Finland | 1 232 | 1.9% | 59.9 | 0.9% |

| Switzerland | 1 098 | 1.7% | 65.1 | 1.0% |

| Norway | 536 | 0.8% | 244.4 | 244.4 |

| Czech Republic | 512 | 0.8% | 70.8 | 1.0% |

| Denmark | 506 | 0.8% | 56.3 | 0.8% |

| Belgium | 465 | 0.7% | 91.7 | 1.3% |

| Slovakia | 332 | 0.5% | 32.4 | 0.5% |

| Spain | 322 | 0.5% | 33.2 | 0.5% |

| Austria | 140 | 0.2% | 19.6 | 0.3% |

| Total | 63 290 | 100.% | 6 841.1 | 100.% |

Major M&A transactions

M&A highlight

- Alcatel-Lucent divested Genesys Labs

- Battery Ventures acquired Jeeves

- CGI acquired Logica

- ENEA divested its consultancy to Xdin

- EQT Private Equity acquired UC4 from Caryle Group

- Ericsson acquired Telcordia

- Francisco Partners acquired Kewill

- HgCapital acquired IRIS Software in 2011

and subsequently split up the company into two units - KANA acquired Sword-Ciboodle from Sword Group

- IFS acquired Metrix

- MICROS Systems acquired Torex

- SAP acquired Successfactors

- SAP acquired Ariba

- SDL acquired Alterian

- Sopra Group acquired Callatay & Wouters

- Thomas Bravo acquired InfoVista

- Vista Equity Partners acquired Misys.

- Misys was later merged to Turaz

- Adobe aquired Neolane

- Advanced Computer Sofware Group

acquired Computer Software Holdings - Kewill acquired Four Soft

- Lefebvre Software acquired Cezanne Software

- Lefebvre Software C=changed name to Talentia

- OMERS Private Equir=ty aquired Civica

- Opentext aquired Cordys

- R12 Kapital acquired Aditro from Nordic Capital Fund

- Sage divested Act! And SalesLogix

- SAP acquired Hybris

- SAP acquired KXEN

- Sopra acquired HR Access

- Symphony acquired Aldata Solution

and merged it with EYC