Bernard-Louis Roques

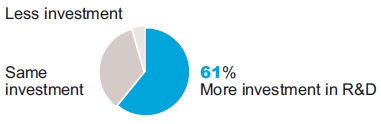

« This latest edition of the Truffle 100 Europe - the 7th- demonstrates that software industry can be extremely dynamic even in a particularly difficult economic climate. This is borne out by strong R&D job creation that promotes added value employment in local areas: European Software vendors employ 60 000 developers, programmers and engineers - which is 60% more than 6 years ago-, the vast majority of them work in Europe, with no short term threat of delocalization. They bolster and boost innovation with an annual investment of 5.7 €B, a growth of 71% in 6 years, and a clear and indisputable commitment to growth and optimism, as this investment represents 86% of their profits.

Yes, the software vendors are a unique, atypical and resilient contributors to European recovery and expansion, they create jobs for the new generations, enhance productivity, and are critical to economic growth!

Yet they lack of the support they deserve in many geographies, as there is no prioritization of a coordinated industrial policy to boost the software industry that should be claiming leadership based on european global economic figures (trade and GDP) but remains far behind the US.

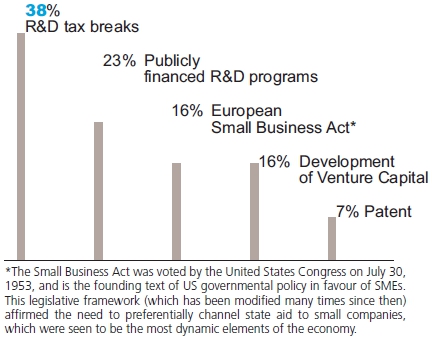

They remain unheard in their call for the implementation of measures such as the Small Business Act (which has a positive budget impact and costs nothing to the governments), R&D tax breaks, or incentives for Venture Capital.

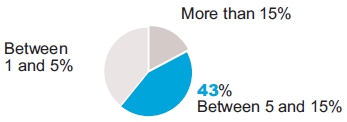

Nevertheless, Software entrepreneurs are unwavering optimists, firmly determined to keep on investing in innovation, committed to growth and added-value job creation, and foresee a 5 to 15% growth in 2013. »

Máire Geoghegan-Quinn

« The Truffle 100 report shows that the European software sector remains a force to be reckoned with, despite the current economic difficulties. Europe depends now more than ever on its innovative sectors in order to be competitive. The Commission recently surveyed some of Europe's companies that invest the most in R&D, and they told us that they expect their investments in research and development to grow by an average of 4% annually over the period 2012 to 2014. The front runner in this group is the software and computer services sector, which expects R&D investment to grow by a very impressive 11% per year on average. This is a welcome call to arms in the fight for growth and jobs.

The European Commission is working hard to boost innovation and will do even more in the future. The Digital Agenda for Europe is helping to reboot the EU economy to get the most out of digital technologies. Our Innovation Union initiative is focused on making innovation easier, be it through a unitary patent, standardisation or access to venture capital.

Above all, I am focused on delivering Horizon 2020, the Commission's new research and innovation programme for 2014-2020. We have proposed a budget of 80 €B, in a framework for R&D and innovation that is more flexible and integrated, with less red tape. It will fund research into specific ICT areas like next generation computing, future internet and micro- and nanoelectronics. Just as importantly, ICT solutions run through the Horizon 2020 programme, for instance in research on energy, climate or health.

The Commission will continue to do its part to help you innovate and prosper. At the same time, we are relying on your entrepreneurship and input to make the European Union an Innovation Union. »

European Commissioner for Research, Innovation and Science

Bo Lykkegaard

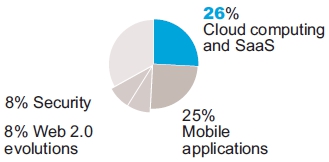

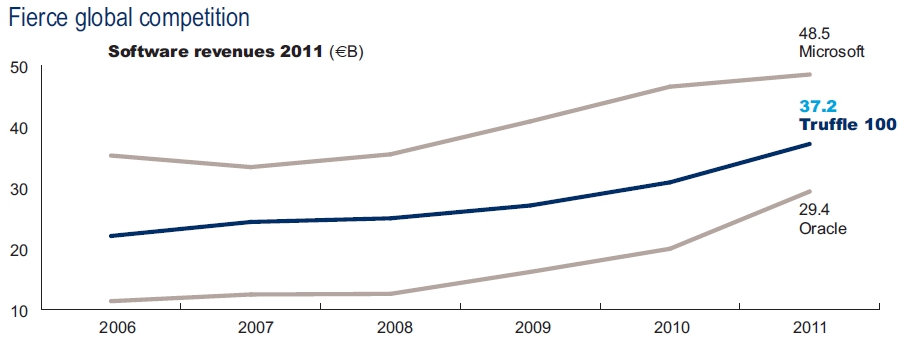

« The European software industry grew strongly in 2010 and 2011 despite the difficult macro-economic climate in Europe. IDC estimates for the first half of 2012 shows sustained and healthy software demand in Europe of 5.7% in constant currency. The vibrant state of the software is a surprise to many, especially those concerned with limited prospects for GDP growth in the EU countries in 2012 and 2013. The explanation is that software is on a different growth trajectory than the rest of the economy. IDC surveys show that productivity improvement and business process automation and consolidation are the top priorities for European organizations at the moment, hence the appetite for software to support these goals. European companies do want to innovate products and services, but it is the innovation on the process side which is the current top priority – and enterprise software plays a significant role to enable this process level innovation.

IDC research also shows that in the software industry, those vendors with the most aggressive R&D investments usually do better than those with more cautious R&D spend. Major product releases are usually followed by a surge in revenues. The software industry is in a state of technology transition in which applications mimic innovations in the consumer world, IT resources become virtual, and IT workloads move to the cloud. This in turn is driving a push to towards more frequent release cycles. As a result, European software vendors must put themselves at the forefront of these changes in order to stay competitive, which only strengthens the case for aggressive and targeted R&D investments. »

Karl-Heinz Streibich

« The software industry is on the cusp of an unprecedented digital revolution. Big Data, the Cloud, Mobile and Social Collaboration are four major disruptive forces that together will transform the way companies do business and react to market changes.

Only the fully digitized, agile, market driven enterprise can react fast enough to survive today’s game-changing threats from competitors and market entrants. We have seen this in the competitive agility of “born digital” companies such as Google, LinkedIn and Amazon. We have also seen Apple transform itself into a digital enterprise and become the most scalable and valuable company in the world.

It is vital to the economic future of the continent that Europe plays a prominent role in this software revolution. This has been recognized in Germany and major steps are being undertaken to ensure that it plays a significant role in the new digital enterprise era.

As an example of an interdisciplinary public-private partnership, the “House of IT” in Darmstadt brings together the four complementary forces of industry, government, education and research to develop and strengthen Europe’s largest software cluster. Nationally, 2012 sees the seventh German IT Summit, established by Chancellor Angela Merkel, raising awareness of the software industry at the highest government levels and resulting in concrete lighthouse projects.

At a European level, Commissioner Kroes, is setting the pace with a European cloud partnership and the Digital Agenda. We must build on these initiatives, across the continent, for our future prosperity. »

Alain de Rouvray

« The “Ter@tec” group and its “Systematic” Centre which brings together eleven highflying companies from our scientific computing industry, are good examples of French-style initiative and innovation. Lots of talent, not much money and… no domestic market. A small company gets itself a smidgeon of subsidies, then a stingy sprinkling of tax credits (C.I.R.); next a learned committee stamps it 'innovative', and boldly enough it launches itself into the turgid waters of international competition. Foolhardy perhaps, cash anaemic most probably, the job creators of the future are further bled dry by an excessive and ever-rising payroll burden (the bulk of their costs) as they struggle to survive, even manage to thrive and hold on until the next transfusion of subsidy money. In the meantime, the specialized Investment Funds called in to prop up (and dilute) these creative entrepreneurs keep their fingers crossed in hope of a big company buyout – foreign if possible (recent examples: IBM, SAP, ANSYS) – having all but given up on an IPO as they consider the pitiful valuation levels of the French market in comparison to the much higher multiples in Europe and North America.

Ten out of the eleven companies in our “Systematic” basket have revenues under 20 €M… with only one posting 100 €M. Entrusting the financing and the future of these (overly) small innovative companies and of their Lilliputian cousins to some future Leviathan of state financing, can only suggest rampant nationalization, or (at best) politically correct subsidization.

This grand dream of an administered economy managed by high-level bureaucrats, sheltered from risk and need, in love with the State and its taxes, and scornful of private companies "addicted" to profits: Will it not turn into a nightmare for our small and medium-sized enterprises, especially for the most innovative ones, where the players have skin in the game, like conquerors off on some thrilling, risky adventure, but one that may soon become an irrelevant anachronism?

For creative innovation to succeed and benefit everyone, a flock of birds of passage will not do ! What is needed is a band of bold privateers, fully commissioned and primed to match the challenges of an exciting new world of true grit and glory. »

Chairman & CEO, ESI Group

Adam Goral

« The Polish market of IT solutions for the financial sector has become mature. However, we still have great prospects for the informatization of enterprises and public administration. The Polish Government is aware of the need to integrate distributed information systems at various public institutions. Development outlook in this sector is still related to e-Government projects. There are also plenty of opportunities open for local governments, as the EU funds will support the development of IT systems dedicated to this level of administration. We see a similar potential for the Asseco Group companies operating especially in the countries of Central and Eastern Europe as well as in the Balkans.

Whereas, the enterprises sector requires IT companies to provide both management information solutions and customer service support systems.

Asseco Poland continues to build its group successfully as it managed to position itself as a reputable producer of software for various sectors of the economy, thus becoming a good partner for American companies that provide hardware, operating systems, databases and software development tools.

We believe that the creation of large European companies specializing in direct customer services lies in the best interest of the world's major IT players, because only such companies can act as their reliable partners. Projects such as the formation of the Asseco Group show that Europe has a lot of unused business potential. This potential needs to be unlocked in order to create a healthy competition in the global IT marketplace, which is now dominated by giant corporations. »

President of the Board of Directors, Asseco Poland S.A.

Antonio Grioli

« With more than 2.300 employees, a distribution network of 1000 partners, 300 €M application software business and over 450,000 procedures installed for more than 85,000 clients Zucchetti is the absolute ISV leader in Italy.

Constantly growing turnover clearly demonstrates, on the one hand, the satisfaction of thousands of existing clients who every year confirm their trust in Zucchetti Group and, on the other, the acquisition of an impressive number of new clients who turn to Zucchetti to improve their performance, upgrade management efficiency and cut costs.

Italy modernization process is late and below average vis-à-vis the rest of Europe and we consider this as an opportunity for growth, especially considering the broad band of initiatives put in place by the president of the Italian Council of Ministers Mario Monti and his Ministers.

As a weakness point, we consider the fact that, despite Information Technology industry involves more people than other industries (consequently generating more jobs) there are less incentives on IT than in other industries. »

Chairman of the Board of Directors, Zucchetti SpA

Laurent Calot

« The French software industry is faced with a new paradox. This industry has all the resources it needs to be successful and yet the situation has never been as complex, elusive or uncertain. Procrastination has become a business norm. Clients would rather wait than invest; decisions are either drawn out or not made at all.

The talk among some of our medium-sized national publishers is of recriminations. In a difficult environment, the new tax on capital gains is seen as unacceptable and protests from software bosses are being expressed for the first time ever.

There is a crisis of confidence. Are we worried about the future? Suffering from a lack of faith in our capabilities? Let’s pull ourselves together and look around us! The economic situation in France may not be thriving, but it is not worse than anywhere else in Europe.

The government has committed to supporting innovation, expanding access to research tax credit and encouraging innovative young companies. Startups, of which there are many in the software industry, are setting the stage for a bright future. New players need to find their place in new trends such as cloud, BI, mobility, social networks and Big Data, which are driving the market forward. We can congratulate ourselves on ranking third among European countries for R&D, with a total amount of software investment very close to that of the UK.

Let’s be confident – the French software industry is innovative, dynamic, solid and creates jobs. We need to keep believing in it. »

CEO, CXP Group

Guy Berruyer

« Europe is losing confidence, but businesses are copingAccording to the Sage Business Index (www.businessindex.sage.com), which surveyed nearly 11,000 businesses in 15 countries during September, the economic outlook among small and medium sized companies has decreased over the last six months, with close to a 5 point drop in confidence since March 2012 – driven particularly by Eurozone nations.

However, there are differences within the European countries. Economic confidence in Spain and Portugal is particularly low and this has also fallen considerably in France and Germany, the latter from 52.08 in March 2012 to 43.5 in September. But there are positive signs. In the UK companies registered a rise in both local market confidence and about their own business prospects, the latter being the highest (58.46) since the Index began two years ago. Even in Spain there has been a rise in businesses’ confidence about their own prospects. Perhaps their economy is bottoming out.

Despite this uncertainty, the entrepreneurial spirit of SMBs shines through. Nearly 70% state that they have adapted to the economic climate, with 27% saying they plan to diversify into new markets and 22% saying they will launch new products in the next year. This strength and resilience is countered 70% of respondents being concerned that governments do not provide sufficient support for them. Specifically, they want reduced bureaucracy (43%) and in particular labour law which is seen as the most burdensome legislation by 48% of firms.

Among all the businesses we work with one thing is certain: it’s tough, but they’ll get through with the right approach and the right support. »

CEO The Sage Group plc

Carlos Pardo

« Within the challenging landscape that is affecting the whole economy, the software sector in Spain keeps on growing, with a 3.1% increment from previous year (see «Information technologies in Spain 2011», from AMETIC). Even when the internal demand is not going through a good moment, technology exports have experienced a positive evolution, increasing by fifth consecutive year.

Betting on innovation, Spanish software vendors like Meta4, company specialized in software for human capital management, continue doing an important effort in research and development. This is undoubtedly the key to increase the competitiveness and productivity of our solutions, and what allows us to go ahead of the market needs and give answer to new trends such as cloud computing, mobility or big data.

The development of national R&D initiatives, aligned with European programs such as Horizon «2020», will be pillars that give us confidence on our capability to maintain our

At a particular level, the growth and good results achieved by Meta4 in the last years, makes us optimistic with regard to the future and our capability to keep on innovating and succeeding in international markets. »

CEO, Meta4

Figures

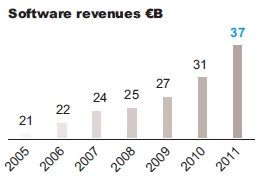

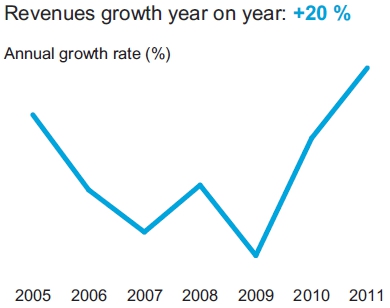

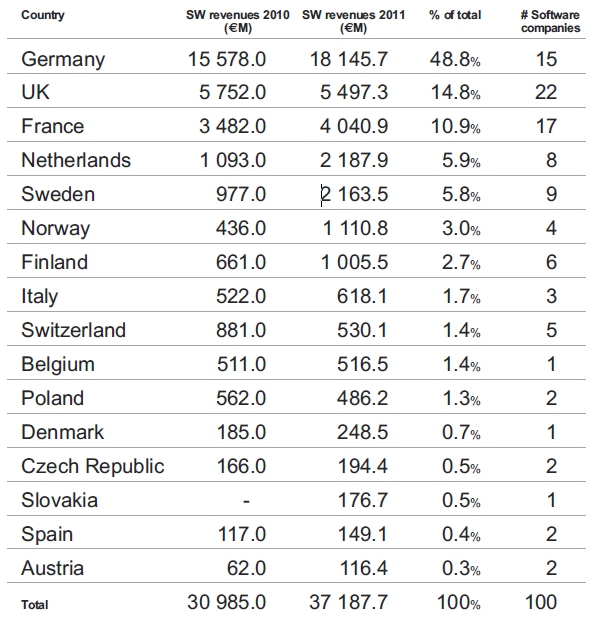

- Impressive revenues growth

20% growth in software revenues at 37.2 €B

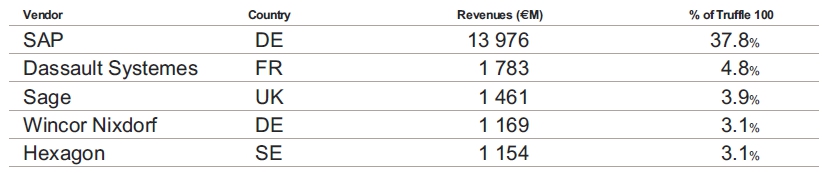

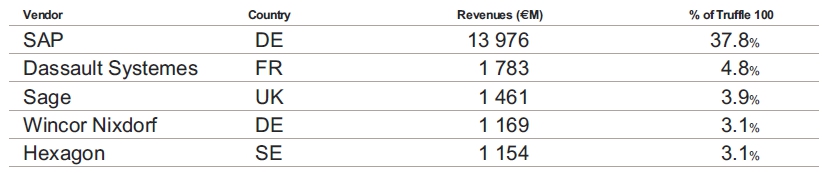

Total revenues for the Truffle 100 are 52.9 €BMore concentration, 76% of revenues come from Top 25

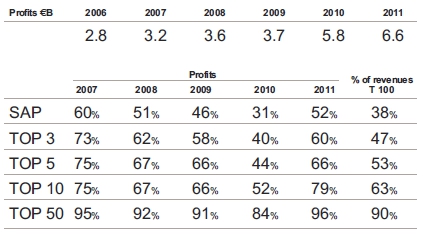

63 % last year% Revenues 2010 2011 SAP

31 % 38 % TOP 3 40 % 46 % TOP 5 44 % 53 % TOP 10 52 % 63 % TOP 50 84 % 90 %

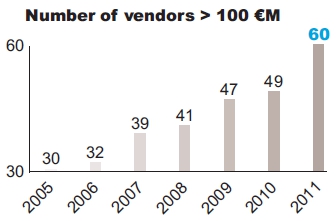

60 vendors have revenues >100 €M

They account for 93% of Truffle 100 revenues

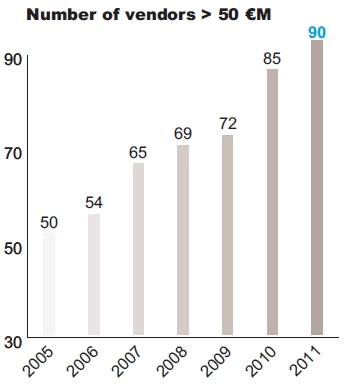

All Truffle 100 have revenues > 44 €M

They account for 99% of Truffle 100 revenues

90 vendors have revenues >50 €M

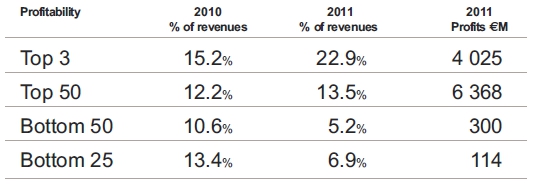

- Improved profitability

6.6 bn€ aggregated net profits, up from 5.8 B€ last year

The bigger, the more profitable

Annual growth rate

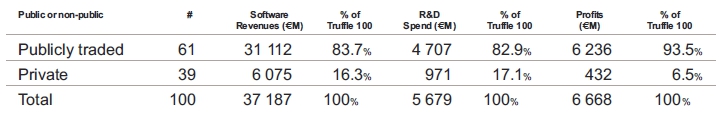

Strong exposition to capital markets

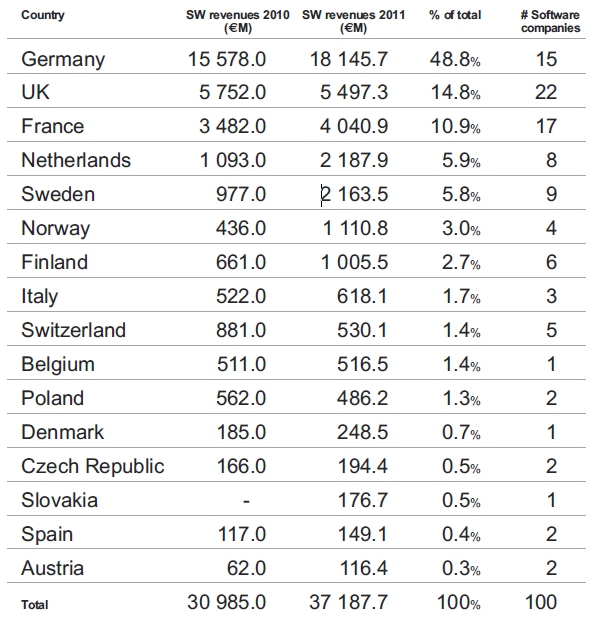

- Breakdown by country

Top 5 countries in Europe represent 86% of software revenues

World-class national champions

- R&D and Jobs

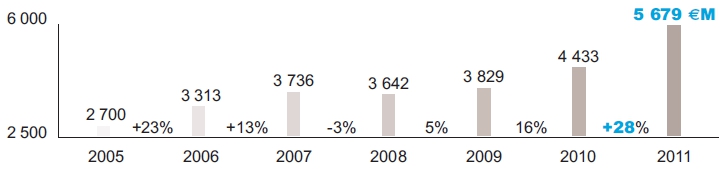

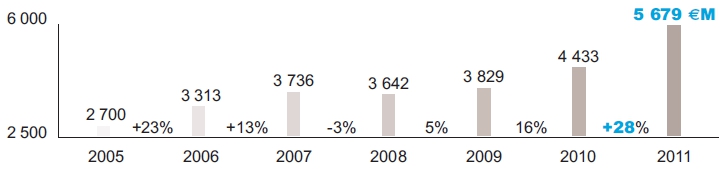

5.7 €B invested in R&D

Total R&D investments

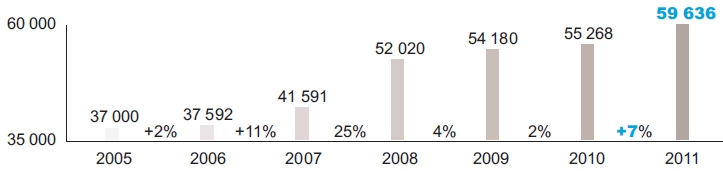

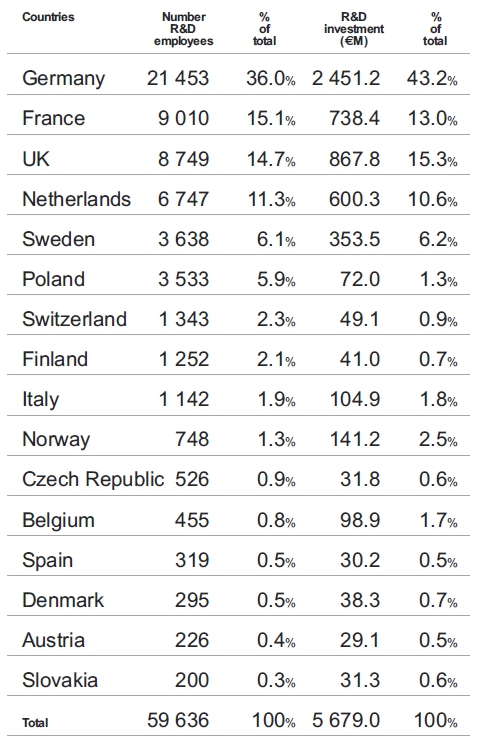

~ 60 000 R&D jobs

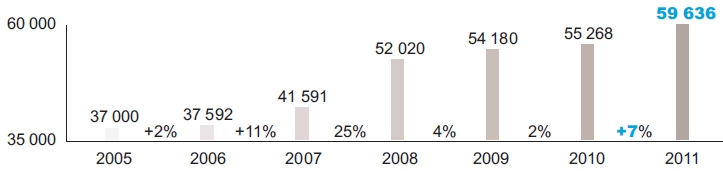

Total R&D headcount

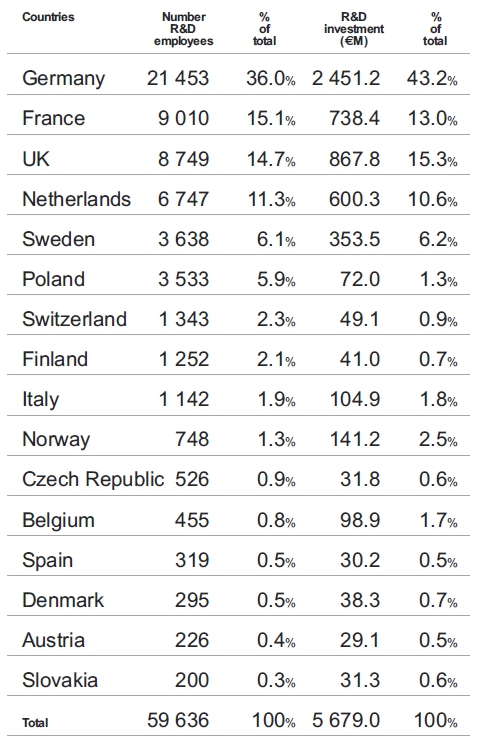

Top 5 countries represent 78%

of total R&D jobs

Breakdown by country

Top 5 countries in Europe represent 86% of software revenues

World-class national champions

R&D and Jobs

5.7 €B invested in R&D

Total R&D investments

~ 60 000 R&D jobs

Total R&D headcount

Top 5 countries represent 78%

of total R&D jobs

Major M&A transactions